Table of Contents Key Takeaways As businesses seek to build trust and ensure security within their team, conducting thorough background checks becomes progressively significant. This evaluative measure extends deep into the roots of the hiring process, affirming the prospective employee’s qualifications and safeguarding the company’s values. In a landscape where professional integrity is paramount, understanding the nuances […]

Category: Business

The Basics of Niche Edits

There are several ways to build backlinks for your website. Some of these include guest posts and niche edits. Niche edits are a great way to add links to existing content without creating new articles. They are also a safer and faster link building strategy than guest posts. Link building Link building is among the […]

Choosing a Reliable Loan Company Matters for Your Financial Future

When it comes to choosing a reliable loan company, there are a few things that you need to keep in mind. This will help you make the best decision possible. First, find a lender that understands your situation and offers flexible lending terms that you can afford. This will save you time and money in […]

What You Need to Know About Pre-Owned Cubicles

If you’re considering buying used cubicles, you should know a few things before making your purchase. First, you’ll need to buy a vacuum cleaner and a dust cloth. Also, you’ll need a can of compressed air for maintenance purposes. Some manufacturers offer repair services, and DIY resources can be found online. But if you need […]

The Importance of Background Screening Services for Small Businesses

Globalization has had a significant impact on today’s workforce. More businesses are expanding internationally, forming cross-border alliances, and seeking new international talent. And with privacy and cyber security being so important, consider educating yourself on cyberlaw: everything you need to know. The near-borderless trade environment has opened up an almost limitless pool of talent. As […]

Step by Step Process to Selling SEO

Here are some tips for a successful sales call. First, build a relationship with your client. Build a proposal that includes a cost breakdown, and avoid objections from potential clients. Avoid protests by focusing on your client’s goals, and create a contract covering all the SEO project’s essential aspects. Your client will be more than […]

Equipment You’ll Need for a Printing Business

When you’re starting a printing business, having the right equipment is essential. Everything from digital devices to standard desk tools is important in delivering the best service to your customers. Not all printing companies are the same, so you should first know what you aim to do. Will you be operating a storefront business, helping your clients […]

4 Bankruptcy Myths People Believe

According to the Administrative Office of the United States Courts, at least 500,000 people in the U.S. file for personal bankruptcy each year. Even though that number is so high, bankruptcy is not talked about frequently and is often seen as a shameful or embarrassing thing to go through. Because of the relative silence surrounding […]

4 Types of Finance Experts

Different kinds of experts can serve as witnesses during financial litigation proceedings. These experts are usually able to understand complex money-related concepts that members of the general public cannot. A lawyer may utilize a finance expert witness to highlight the misdeeds of a particular company or to showcase that an individual’s financial health was compromised by the […]

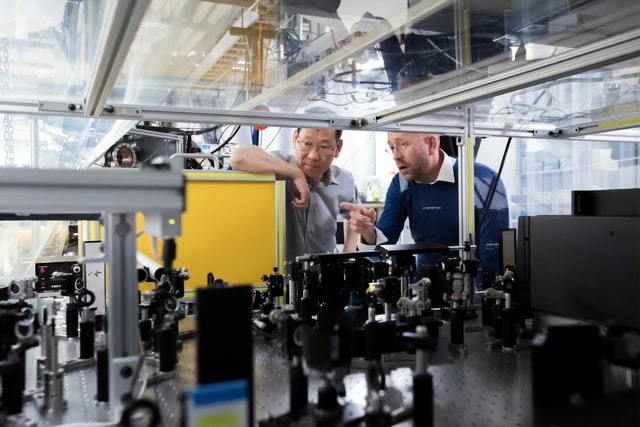

Is Your Industrial Plant Efficient and Profitable? Consider These Four Factors

Business owners focus on the bottom line; therefore, when running an industrial plant, managers should consider factors that influence operations, focusing on reducing factors that interfere with production. The easier things go, and the more consistent they are, the more likely the operation is to increase revenue. With this in mind, it’s important to evaluate […]